When it comes to retirement planning, there are several strategies employers use to help their employees save money for the future. Most employers, particularly publicly traded companies, offer employees some sort of retirement plan like a 401(k). Many of these companies also offer an option to purchase company stock as part of the employer-sponsored plan. Some companies also pay employees with stock by contributing shares to their retirement plan.

There are lots of different company retirement strategies, and when participating in any of them as an employee, it’s important to know how you’ll be affected by taxes. All the plans mentioned above are tax deferred, meaning you pay taxes on the distributions, rather than on the initial contribution.

IRS Code Section 402 allows plan participants the opportunity to pay a lower tax rate when they take lump-sum distributions of company stock from an employer-sponsored plan. This is referred to as a Net Unrealized Appreciation (NUA) strategy, and in this blog, we’ll discuss how it works, who’s eligible to use it, and how to know if it might be beneficial for you.

What’s the Benefit of using an NUA strategy?

When you take a distribution from a tax-deferred retirement plan (like a 401k or IRA), the amount you withdraw is treated as ordinary income and is therefore taxed at ordinary income-tax rates, which can be as high as 39.6%. For example, let’s say you had $500,000 worth of company stock in your plan and the amount you paid for the shares was $100,000. If you were to take a $500,000 distribution as cash, then the entire amount—including the appreciated $400,000—would be taxed at ordinary income-tax rates.

An NUA strategy, on the other hand, allows plan participants to pay a capital gains tax rate (which is just 15% for most individuals) on the unrealized appreciation of the stock (in this example, $400,000) from the employer-sponsored plan.

How it works

An NUA strategy allows you to distribute the shares from an employer sponsored plan into a taxable brokerage account. When you do this, you still have to pay regular income tax, but only on the cost basis of your shares (which, in the example above, is $100,000). The appreciation of the stock ($400,000) would then be subject to long-term capital gains tax rates, which you would pay when you sold the shares. (There is no requirement to sell the shares; you can hold them as long as you like, sell some of them, or sell all of them.)

What if I have other funds in my retirement plan besides company stock?

One of the qualifications to use an NUA strategy is that your entire plan balance–including any cash or other funds in addition to the company stock–must be rolled over within the same calendar year. Fortunately, if you have cash or other funds in your account and want to leverage an NUA strategy, you can roll over the remaining funds into an IRA, thus retaining their tax-deferred status.

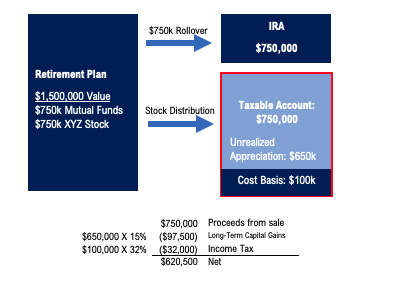

Here’s an example of how that would work:

Tom recently retired from XYZ Corp, a tech company that has seen massive growth in the 30 years Tom worked there. Tom participated in the company-sponsored retirement plan, and his account is currently worth $1,500,000. Below are the assets in his plan:

- $750,000 in various mutual funds

- $750,000 in XYZ Corp stock (Cost basis is $100,000)

Tom has always wanted to buy a vacation home on the beach and has finally decided to pull the trigger. He wants to use his company stock to pay for the beach house, since he thinks it’s time to diversify his holdings anyway. He is in the 32% federal tax bracket.

Tom collaborates with his accountant and his financial adviser, and together, they decide that an NUA strategy would save him a significant amount of money. Here is what they do:

- Distribute the stock shares to a taxable brokerage account. Tom pays $32,000 in ordinary income tax on the cost basis of his shares ($100,000 cost basis X his 32% tax rate).

- Tom sells the stock once it is in the brokerage account and pays $97,500 in long-term capital gains tax ($650,000 unrealized appreciation X 15% long-term capital gains rate). (Note: Tom does not have to sell all the shares. Depending on the price of his beach house, he could sell enough shares to cover the cost and leave the rest until he needed them.)

- Then, they rollover the remaining plan balance that was invested in various mutual funds ($750,000) into an IRA. Tom will not have to pay taxes on this portion of his plan until he takes a distribution from this account.

- Tom now has a budget of $620,500 for his beach house! ($750,000 in shares minus $32,000 in income tax, minus $97,500 in capital gains tax—leaves him with $620,500.)

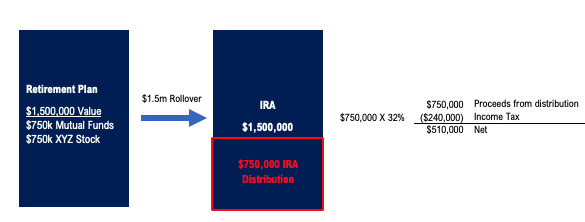

If Tom were to take the $750,000 directly from his plan or IRA (rather than distributing the shares to a taxable brokerage account), he would be required to pay his ordinary income tax rate on the entire amount—$750,000 X 32%—a whopping $240,000 in taxes! But by leveraging an NUA strategy, he saves more than $110,000.

Who is eligible to use an NUA Strategy?

Below are some stipulations to leverage an NUA strategy:

An individual must be eligible to take a lump-sum distribution from their retirement plan, either by separation of service, reaching age 59 ½, disability, or death of the participant.

The stock must be directly transferred (in kind) to a taxable brokerage account from the employer-sponsored retirement plan. The shares cannot be sold in the retirement plan and rebought in the brokerage; it must be the same shares.

There are some factors that can disqualify a person from using this strategy, so if you’re considering it, it’s best to discuss your options with a financial professional.

How do I know if an NUA strategy is right for me?

Even if you’re eligible to use an NUA strategy, that doesn’t mean it’ll be the right choice for you. There are advantages and disadvantages to this approach, and it’s important to understand both before using it in your plan. Generally, this strategy generally works best for people who are in higher tax brackets and whose stock has greatly appreciated in value.

Ultimately, whether this strategy makes sense for you is dependent on your unique situation. It needs to align with your overarching financial goals and complement the rest of your plan. That’s why it’s extremely important to discuss your options with your financial adviser and tax adviser.

If you want to know more, we’re here to help. Our advisers can help you clarify your goals, give you a better understanding of your financial situation, and help you broach the subject of an NUA strategy with your tax adviser. We’re also happy to run calculations for you free of charge. Call or email to schedule a consultation with one of our advisers today.

This article is intended to be for general information about the topic(s) described only, and should not be used as financial advice specific to your situation. For financial advice pertinent to your lifestyle, goals, risk tolerance and opportunities, please contact a financial professional.