With the current economic climate, we thought it would be the perfect time to discuss risk tolerance and how it relates to investor behavior. Without an intentional strategy that reflects your personal goals, times of turmoil (and growth, for that matter) can influence financial decisions in a way that’s not always beneficial. That’s why it’s important to identify your own risk tolerance and understand how it relates to your investment strategy.

What is Risk Tolerance?

Risk tolerance is a measure of how much decline an investor is willing to accept in their portfolio in exchange for a given amount of expected positive return. Essentially, it’s how much loss someone is willing to risk in exchange for what is expected to be a greater return.

When developing a portfolio, investors with a low risk tolerance typically rely more on conservative assets like cash equivalents, bonds or other types of fixed income, whereas investors with a high risk tolerance might lean more heavily on stocks. When it comes to risk tolerance and portfolio allocation, there are five commonly accepted target stock allocations (or equity allocations):

- Aggressive: 80-100% of investments in equities

- Moderately Aggressive: 60-80% in equities

- Moderate: 50-60% in equities

- Moderately Conservative: 30-50% in equities

- Conservative: 0-30% in equities

Using these guidelines, the goal is to invest according to an investor’s risk tolerance. So if someone isn’t willing to tolerate much risk, they might invest, say, 35% of their portfolio in stocks. The remaining percentage would be invested in a mix of bonds, fixed income, or alternatives like commodities, hedge funds, venture capital, real estate, or money market funds. Alternative investments can help mitigate volatility in a portfolio because they are typically less correlated to other asset classes.

Skewed Perceptions

An issue arises when investors don’t fully understand the level of risk involved with specific investments, or they base their tolerance for risk on positive experiences.

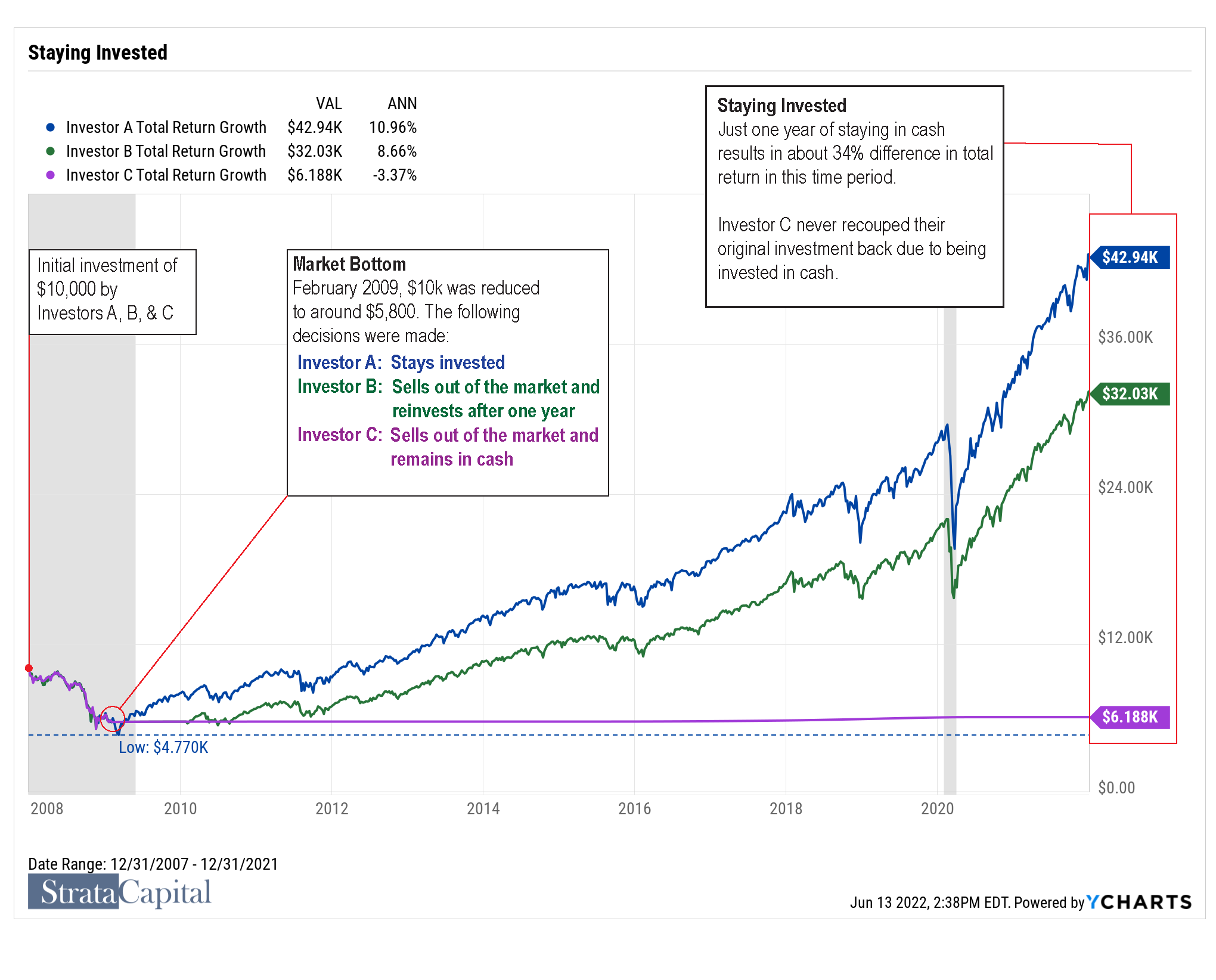

For example, super bull markets often create a sense of security for non-professional investors that causes them to invest their hard-earned savings in investments that have greater risk than they realize. That’s because the only trend the investor has seen are those securities rising in value for long periods of time. And while there are always intra-year lows with these types of investments, the market has typically bounced back very quickly, which only adds to an investor’s confidence. Consequently, some investors believe they can tolerate higher-risk investments because they’ve only seen the positive consequences of those investments.

Unfortunately, risk tolerance isn’t meant to be a measure of the “good times.” It’s meant to measure how much loss an investor can stomach in volatile seasons like we’re experiencing now, or in major market meltdowns like the financial crisis of 2008.

Evaluating Your Risk Tolerance

So how can an investor determine their true risk tolerance? There are several factors to consider, but one method is to complete a risk tolerance questionnaire like the one we’ve included below. In general, you should ask yourself the following questions:

- Did I feel anxious during the most recent downturn? (If you’re considering selling because of the recent volatility, that might be a sign you’re invested more aggressively than you should be.)

- Have I “fear sold” recently?

- Do I prefer to wait to invest until the market looks healthier?

Answering these questions will give you a better idea of your tolerance for risk in the market, which will help you choose investments that are compatible with your risk tolerance and goals.

Time Horizons & Risk Tolerance

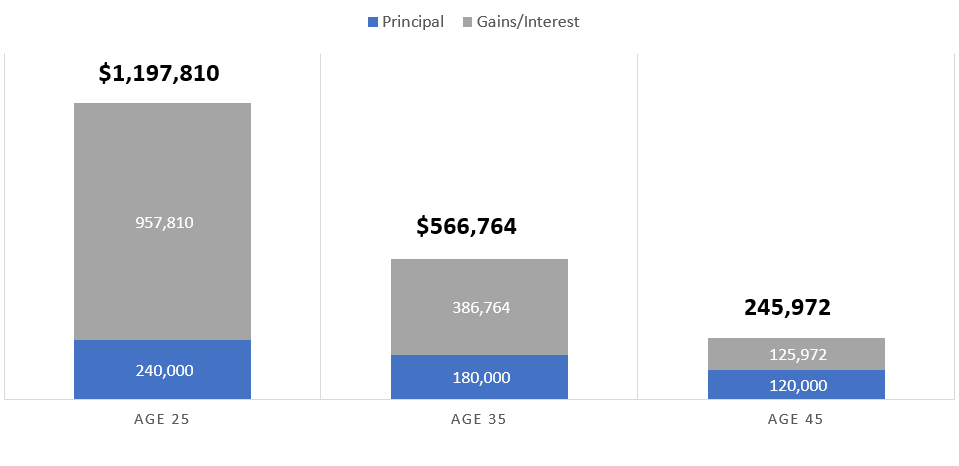

A person’s risk tolerance can vary according to their goals. For example, if someone is saving money for retirement, their risk tolerance will likely be higher the further out they are from retirement and get more conservative as they get closer. This allows for the investor to avoid seeing a big decline in their account upon entering retirement. That’s why it’s important to consider your time horizon—this is the amount of time you can hold an investment before you need to sell it to meet a cashflow need or to accomplish a financial goal.

There are two types of time horizons: an income cashflow time horizon and a lump-sum time horizon.

Income cashflow time horizons correlate with an investor’s need to generate income during a long period of time (retirement being the most common example of this). When someone is planning for retirement, the most common (and often recommended) strategy is to invest money in a vessel designed to support long-term income (rather than invest money throughout your life, sell those investments when you retire, and live off the profit). The goal is for the funds to last throughout the investor’s lifetime and keep pace with inflation in the process. When implemented well, this strategy should leave the investor with money left over at the end of their life, allowing them to leave something behind for their beneficiaries.

A lump-sum time horizon, on the other hand, is used when someone invests money into something with the intention of selling it at the end of a predetermined period. For example, someone might purchase a vacation home or other property with the intention of selling it after 15 years or so.

Whatever your goals, it’s important to understand how your time horizon plays into your investment strategy. If mismanaged, you could face some disappointing consequences when it comes time for you to meet your goal. For example, if you need to see a return in a short period of time but you’re too aggressive with your investments, you might lose too much money and run out of time to gain it back. Conversely, if you’re too conservative with a long-term goal, you might reach the end of your time horizon without having met your desired return.

The Takeaway: The purpose of your investments helps you determine your time horizon.

Incorporating Risk Tolerance Into Your Financial Plan

Most people have more than one financial goal; consequently, your time horizon and risk tolerance might look different for different buckets of money you allocate to accomplish specific goals. (For example, if you need cash from an investment in less than two years, your risk tolerance and strategy will look different for this goal than it will for your long-term retirement goal.)

Once you determine when you need to spend your money, you can select investments that match those timeframes. We recommend working with a financial advisor and completing a cashflow worksheet to determine how much you can and should save to accomplish your goals.

The earlier you plan, the earlier you can begin saving—which allows you to leverage the market to help you save. And the more return you can earn from market growth, the less of your money you’ll need to fund your goal.

The Takeaway: Choosing investments should be done only after you know your time horizon and risk tolerance.