If you’ve ever considered pulling money out of your 401(k) prematurely to cover more immediate financial needs or desires, you’re not alone. Individuals often find themselves contemplating early withdrawals as a quick solution, with the allure of immediate access to funds overshadowing longer-term concerns. But while tapping into your retirement accounts may seem like a convenience worth using to your advantage, ease of access frequently clouds judgment when it comes to the true cost.

What if you’re decades away from retirement and your career is progressing well, but you’re still renting and want to buy your first home? Using the money stashed in your 401(k) toward a downpayment can be tempting, but is this a sound choice? Maybe you’ve dreamed of starting your own business and have the skills to succeed; would bootstrapping with your 401(k) be a good idea? Or perhaps you’ve been laid off, your industry is in a lull, and your kids’ private school tuition is due soon. Should you turn to your 401(k)?

The answer is that it depends. Prematurely drawing on your 401(k) comes with fees, taxes, and the potential for significant gains to be lost over time.

Our aim is not to dissuade you outright, as it may be the most suitable course of action in your situation, but rather to provide clear insight into the potential financial impact of early 401(k) withdrawal. We encourage you to carefully analyze the numbers and assess your situation against the full range of implications for your retirement future.

By looking at the bigger picture and exploring possible alternatives, you can make an informed choice with confidence and foresight.

Real-World Dilema: Should Ben and Kate Tap into His 401(k) to Buy a Home?

Let’s explore a scenario that’s become increasingly common in the midst of soaring home prices and mortgage interest rates. Even homebuyers who have carefully planned and saved diligently may find themselves scrambling to bring more money than expected to the table to get the deal closed. Is overcoming this obstacle worth making an early 401(k) withdrawal?

Ben and Kate are 30 years old, newly married, and are in the process of buying a home. The market is competitive, so it turns out that they will need an additional $50,000 for a down payment and other closing costs. Beyond what they’ve already earmarked for the home purchase, their cash reserves have run dry, so they look to Ben’s 401(k). The balance is currently $125,000.

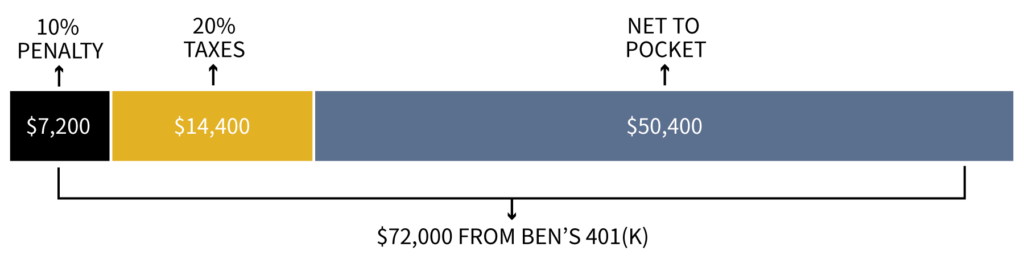

For Ben and Kate to net the $50,000 needed, they need to withdraw $72,000 from Ben’s 401(k). This is to account for a 10% premature withdrawal penalty ($7,200) and 20% in taxes ($14,400). 72,000 – 7,200 – 14,400 = $50,400. This penalty applies to those withdrawing from a retirement account (401(k), IRA, etc.) prior to reaching age 59 ½. While there are some exceptions, it’s important to consult with a financial advisor before making any withdrawals.

So you may be thinking, ‘Yes, it is unfortunate that they have to pull out more money to account for taxes and penalties. But in the grand scheme of things, it’s not that much. It’s better than continuing to rent, right?’ That is, until you start to consider the future value of the $72,000 withdrawal. Let’s walk through two scenarios to show you what this looks like.

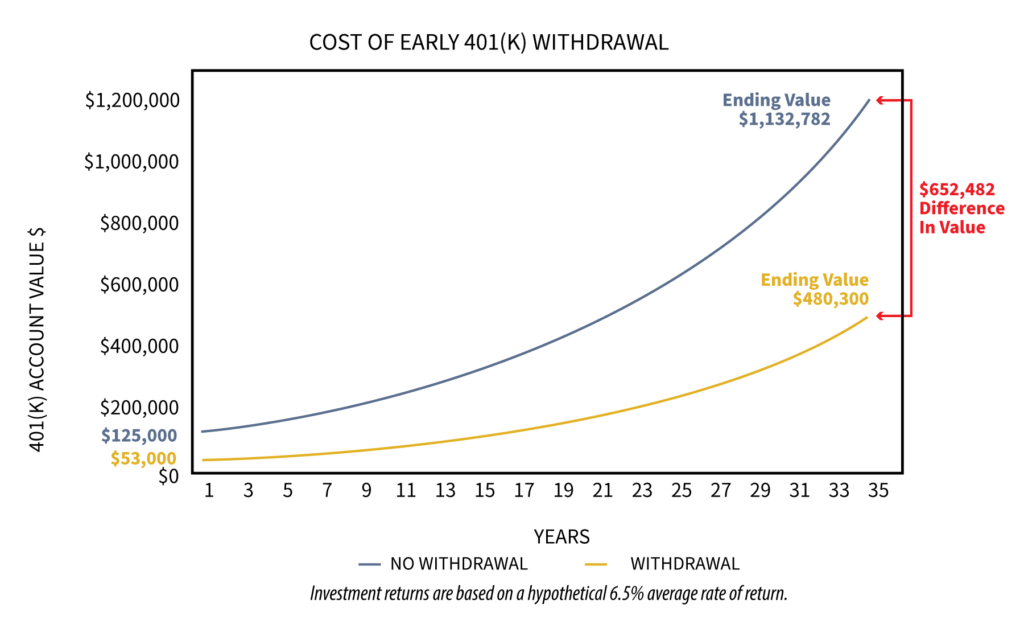

In Scenario #1, represented by the green line, Ben and Kate decide not to pull the extra funds from Ben’s 401(k). In Scenario #2, Ben and Kate withdraw $72,000 from Ben’s 401(k) to cover the down payment. In both cases, the 401(k) has an annual average rate of return of 6.5%.

You can see the power of compounding returns in the graph. Scenario #1 has Ben’s 401(k) balance at over $1.1 million when he’s 65. But in Scenario #2, the account balance at 65 is just over $480,000.

The difference is a whopping $652,482!

By looking at the numbers, you can see that Ben’s $72,000 withdrawal can potentially become a $652,000 cost to his and Kate’s future. This is a number that can greatly impact when they retire and what kind of lifestyle they have in retirement.

Sometimes you have no choice but to withdraw from your retirement accounts, and that’s okay. If pulling the money out now offers the boost you need that allows you to raise your family in a great neighborhood, you might consider it a no-brainer. And if the alternative to using this available resource is foreclosure following an unexpected stretch of unemployment or foregoing an expensive medical treatment that’s not covered by insurance, your future retirement may not be your top priority.

However, in every situation, it is extremely important to understand how these decisions impact your long-term financial goals. Understanding the impact on your future self may sway your decision-making when considering a large premature 401(k) withdrawal.

Alternatives to Withdrawing Funds from Your 401(k)

- Taxable Investment Accounts: There are no penalties for pulling money out of your brokerage account. One thing to look at is the unrealized gain on your positions. If you’ve held your positions for over a year, then you would pay long-term capital gains tax on the gains only, which is typically less than ordinary income tax.

- Securities Backed Line of Credit (SBLOC): Let’s say you have a brokerage account but don’t want to sell your investments. Taking a line of credit against your investments could be a good alternative solution. Of course, you have to repay this loan, making it an added monthly expense, but this option usually works best as a short-term solution. For example, say that Kate had a $50,000 net bonus being paid out in 4 months. Taking out an SBLOC for the down payment and then using the bonus to pay off the line of credit could be a good option.

- Borrowing from Family or “Early Inheritance”: Not everyone has this option, but for those who do, it can save you a ton of money. If you have a family member that you know is leaving you money when they pass, showing them the numbers we went through in the article may motivate them to give you some of your inheritance early.

The path you take depends on your specific finances and resources. You’re more likely to miss opportunities if you assume there’s only one way to go and allow your judgment to be clouded by emotions. Making rash moves can be costly.

Should You Tap into Your 401(k) Early?

The decision to withdraw funds from your 401(k) should never be taken lightly. By understanding the true cost of early withdrawals, including the fees, taxes, and long-term impact, you gain the power to make an informed choice. Rather than heedlessly opting for the easy solution, take the time to assess your needs, weigh the potential losses against gains, and explore alternatives. Remember, your 401(k) is a valuable tool in securing your financial future.

At Strata Capital, we specialize in providing insightful financial analysis and guidance to help you make well-informed choices that align with your long-term goals. Our team can run the numbers, assess the impact on your financial future, and work with you to explore alternatives that may be more favorable. We welcome the opportunity to provide you with financial direction to help you live your best life. Feel free to schedule your consultation here.

Strata Capital is a wealth management firm serving corporate executives, professionals, and entrepreneurs in the New York Tri-State Area, focusing on corporate benefits and executive compensation. Co-founded by David D’Albero and Carmine Coppola, the firm specializes in making the complex simple to ensure clients feel confident in their financial decisions. They can be reached by phone at (212) 367-2855, via email at carmine@stratacapital.co, or by visiting their website at stratacapital.co.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This material was prepared by Crystal Marketing Solutions, LLC, and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate and is intended merely for educational purposes, not as advice.