By Carmine Coppola

Let’s face it: retirement is going to be expensive. As inflation climbs, healthcare expenses surge, and sticker shock becomes the norm, it might be time to reconsider your savings strategies. The good news is that your MetLife 401(k) comes with an often-overlooked advantage: the ability to contribute after-tax funds, even after you have maxed out your allowable IRS limit.

Depending on when you start and how aggressive your approach is, you’ll need to stash away at least 10-15% of your income to fund your lifestyle in retirement. Even maxing out your regular and catch-up contributions could fall far short of your needs. When you’re accustomed to a higher-than-average income, setting aside $23,000 annually if you’re under 50 years of age and $30,500 if over 50, simply isn’t enough.

What Are After-Tax Contributions?

Not every 401(k) plan allows after-tax contributions, but your MetLife 401(k) offers this option as an added benefit — a special kind of retirement plan contribution available in addition to traditional pre-tax and Roth contributions.

It’s called “after-tax” because the money contributed has already been subjected to income tax at the time of deposit, and it doesn’t provide an immediate tax deduction like pre-tax contributions. However, the earnings on after-tax contributions grow tax-deferred within the 401(k) account, and they are also subject to income tax when withdrawn in retirement.

The MetLife 401(k) allows you to contribute between 3% and 45% of your eligible pay to the plan — unless you are considered a highly compensated employee; if so, those limits vary and can change year-to-year. The set contribution limits are for combined before-tax 401(k) savings contributions, Roth 401(k) savings contributions, and/or after-tax savings contributions.

It is important to note that a maximum of 11% of your contributions can be after-tax savings contributions.

So Why Use the After-Tax Contribution Option?

The IRS limits annual contributions for 401(k) plans for pre-tax and Roth contributions. The after-tax option allows for higher limits. Again, as of 2024, the combined limit for pre-tax and Roth contributions is $23,000 per year, or $30,500 if you’re 50 or older. However, the total contribution limit, including after-tax contributions, is significantly higher — up to $69,000 or $76,500 for those aged 50 or older in 2023. For those who may be behind on retirement savings and have the means to do so, after-tax contributions can be a viable strategy to make up some ground.

For example, let’s say you have a total income of $200,000 in 2023, are under 50 years old, and have maxed out the pre-tax and Roth 401(k) contributions at $23,000. Since MetLife will match $8,000, the total contributions will be $31,000. That leaves a gap of $38,000 before you hit the total contribution limit of $69,000. Because MetLife allows up to 11% in after-tax contributions, you can make up to $22,000 ($200,000 x 11%) in after-tax 401(k) contributions.

Conversion to Roth — A Backdoor Strategy to Optimize Your Savings

Another big advantage of MetLife’s 401(k) plan is that it allows participants to perform in-service rollovers. An in-service rollover refers to the transfer of funds from an employer-sponsored plan to an individual retirement account (IRA) or Roth IRA while you are still actively employed by the company. This makes it possible for participants who have contributed after-tax to roll over their after-tax contributions to a Roth IRA.

A Roth conversion can be a valuable strategy for building a tax-free retirement income stream — especially for those in a high tax bracket who do not qualify for a Roth and would like to continue getting the maximum deduction for pre-tax contributions.

Since after-tax contributions have already been taxed, the conversion to a Roth account won’t trigger additional taxes. The only exception is if you have generated earnings on those after-tax contributions, which is typically a result of when the funds have been sitting in the account for a while. It doesn’t mean you can’t do the conversion; it simply means that those earnings will need to be rolled into a traditional IRA in order to avoid taxation. To minimize potential tax implications, your contributions can go to the Roth account, and any earnings will go to a traditional pre-tax IRA.

In other words, take note: if you implement the backdoor Roth strategy, it is important to complete the conversion as quickly as possible — so that all earnings can be withdrawn tax-free.

A word of caution: this strategy can have some negative consequences if not done properly. It can even adversely affect your company match. Before considering a strategy like this, we recommend first speaking to Aon Hewitt to find out how much of your funds are eligible and then consult a financial and tax professional.

Tax-Deferred vs. Tax-Free Growth – The Difference Could Be Huge!

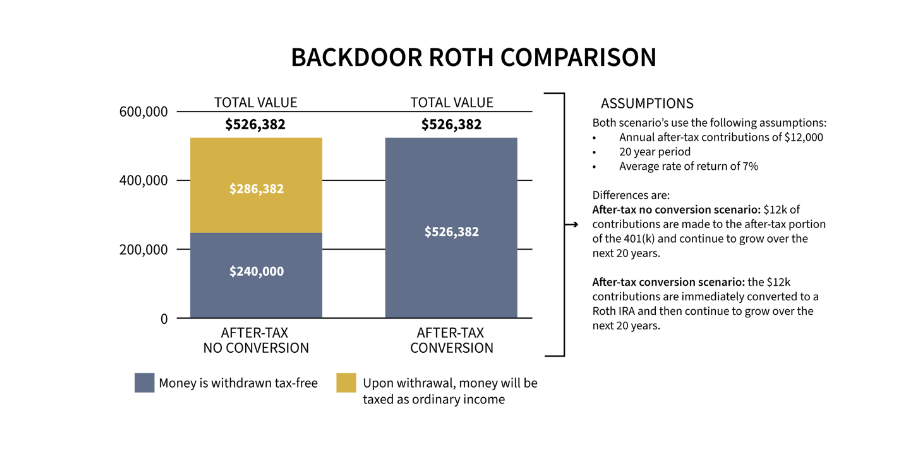

Like pre-tax and Roth contributions, after-tax contributions grow tax-deferred until you withdraw the funds in retirement. What’s often overlooked is the impact of rolling the dollars to a Roth right away versus leaving the funds to grow in the plan.

If you plan to contribute a large amount, consider moving the funds to a Roth account shortly after making the contribution. This is what is referred to as a mega backdoor Roth. In this scenario, the funds will have the opportunity not only to grow tax-deferred, but the withdrawals will also be tax-free. To learn more about this strategy, check out our blog on back-door Roth contributions.

After-tax contributions can be a remarkably impactful addition to a retirement savings strategy. But before you jump in, it’s important to review your cash flow and determine whether contributing extra dollars is feasible. Additionally, it’s critical to note that company rules and federal laws for 401(k) plans can change. Always check with your plan administrator and consult with a financial advisor or tax professional to understand how after-tax contributions fit into your overall retirement and tax planning strategy.

Strata Capital is a wealth management firm serving corporate executives, professionals, and entrepreneurs in the New York Tri-State Area, focusing on corporate benefits and executive compensation. Co-founded by David D’Albero and Carmine Coppola, the firm specializes in making the complex simple to ensure clients feel confident in their financial decisions. They can be reached by phone at (212) 367-2855, via email at carmine@stratacapital.co, or by visiting their website at stratacapital.co.

Cornerstone Planning Group, Inc., (“CSPG”) is an SEC registered investment advisory firm. The information contained herein should not be construed as personalized investment advice and should not be considered as a solicitation for investment advisory service. The information (e.g., tax ) provided is believed to be accurate however CSPG does not guarantee or otherwise warrant such information. For more information regarding CSPG you can refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) and review our Form ADV Brochure and other disclosures.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.