By Carmine Coppola

Selling your home can be one of the most rewarding financial moves you make — but it can also lead to an unexpected tax bill if you’re not prepared.

For many New Jersey homeowners, the surge in property values over the past several years has created significant equity. According to the New Jersey Association of Realtors, the median sales price of a single-family home in New Jersey reached $525,000 as of March 2025, up nearly 22% since early 2022 (NJAR Housing Statistics, March 2025).

That’s great news if you’re selling — but it also means capital gains tax could become a very real, very expensive issue.

Fortunately, with proper planning, you can potentially avoid or minimize capital gains taxes and keep more of your hard-earned profit.

Understanding Capital Gains Tax on Home Sales

When you sell your home for more than you paid for it (plus improvements), the difference is a capital gain. The IRS taxes these gains based on how long you held the property:

- Short-term capital gains (ownership less than one year) are taxed at your ordinary income tax rate — up to 37% for high earners (IRS Topic No. 409).

- Long-term capital gains (ownership greater than one year) are taxed at reduced rates: typically 15% or 20% depending on your taxable income (IRS Capital Gains Tax Rates, 2025).

Owning your property for at least one year before selling can make a significant difference in your after-tax profits.

The $250,000/$500,000 Capital Gains Exclusion

If you are selling your primary residence, you may qualify to exclude part of your gain from taxes:

- $250,000 of gain for single filers

- $500,000 of gain for married couples filing jointly

This exclusion applies if you:

- Owned the home for at least two of the last five years,

- Lived in the home as your primary residence for at least two of those years,

- Haven’t excluded gain from another home sale within the last two years.

These conditions are outlined clearly in IRS Topic No. 701.

In a market like New Jersey, where property values have appreciated sharply in high-demand areas such as Bergen County, Monmouth County, and Essex County, this exclusion is more important than ever.

Real-World New Jersey Scenarios

Scenario 1: The Commuter Condo Owner

Amelia bought a Jersey City condo in 2017 for $400,000. She lived there for three years before renting it out. In 2025, she sells it for $700,000. Because she met the ownership and use test, she qualifies for the $250,000 exclusion, shielding most of her $300,000 gain from taxes.

Scenario 2: Long-Term Owners in Short Hills

Frank and Elena have owned their Short Hills home since 1980, purchased at $180,000. They now sell for $2 million. Thanks to the $500,000 exclusion, and careful planning to adjust their cost basis through documented home improvements, they significantly reduce their taxable gain.

Scenario 3: The Short Sale Mistake

Anthony and Lisa bought a second home at the Jersey Shore in 2024 and sold it in 2025 for a gain. Because they didn’t meet the two-year ownership requirement, their gain was fully taxable as short-term capital gains at ordinary income tax rates.

How to Reduce Capital Gains Taxes in New Jersey

- Increase Your Cost Basis

Add the value of eligible home improvements to your original purchase price — this reduces the taxable portion of your gain. Improvements include renovations like new roofs, kitchens, and HVAC systems (IRS Publication 523). - Consider a 1031 Exchange (For Investment Properties)

If you sell a New Jersey investment property, you can defer capital gains taxes by purchasing another like-kind investment property within the IRS timelines (IRS Like-Kind Exchanges). - Plan Smart Estate Transfers

New Jersey no longer has an estate tax, but it does still impose an inheritance tax depending on the beneficiary relationship (State of New Jersey – Inheritance Tax).

Passing property through an estate plan with a stepped-up basis can eliminate years of taxable gains.

Why Local Expertise Matters

New Jersey’s housing market is unique. High property values in suburban NYC commuter towns like Montclair, Summit, and Ridgewood mean that even modest homes can trigger six-figure gains.

And New Jersey’s layered tax system — including property taxes (the highest median property tax bill in the U.S. per WalletHub 2025) — makes strategic planning essential.

Selling a home without understanding these nuances could mean an unexpected tax bill that easily eats away your hard-earned equity.

The Bottom Line

Selling your home — whether in New Jersey’s bustling suburbs or along the Shore — is a major financial event. With the right guidance, you can preserve more of your wealth, minimize taxes, and ensure you keep what you’ve built.

At Strata Capital, we specialize in helping high-income professionals and executives navigate complex financial situations with clarity and confidence.

If you’re considering a sale in the next 12–24 months, let’s have a conversation about how to protect your profits.

Strata Capital is a wealth management firm serving corporate executives, professionals, and entrepreneurs in the New York Tri-State Area, focusing on corporate benefits and executive compensation. Co-founded by David D’Albero and Carmine Coppola, the firm specializes in making the complex simple to ensure clients feel confident in their financial decisions. They can be reached by phone at (212) 367-2855, via email at carmine@stratacapital.co, or by visiting their website at stratacapital.co.

Cornerstone Planning Group, Inc., (“CSPG”) is an SEC registered investment advisory firm. The information contained herein should not be construed as personalized investment advice and should not be considered as a solicitation for investment advisory service. The information (e.g., tax ) provided is believed to be accurate however CSPG does not guarantee or otherwise warrant such information. For more information regarding CSPG you can refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) and review our Form ADV Brochure and other disclosures.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

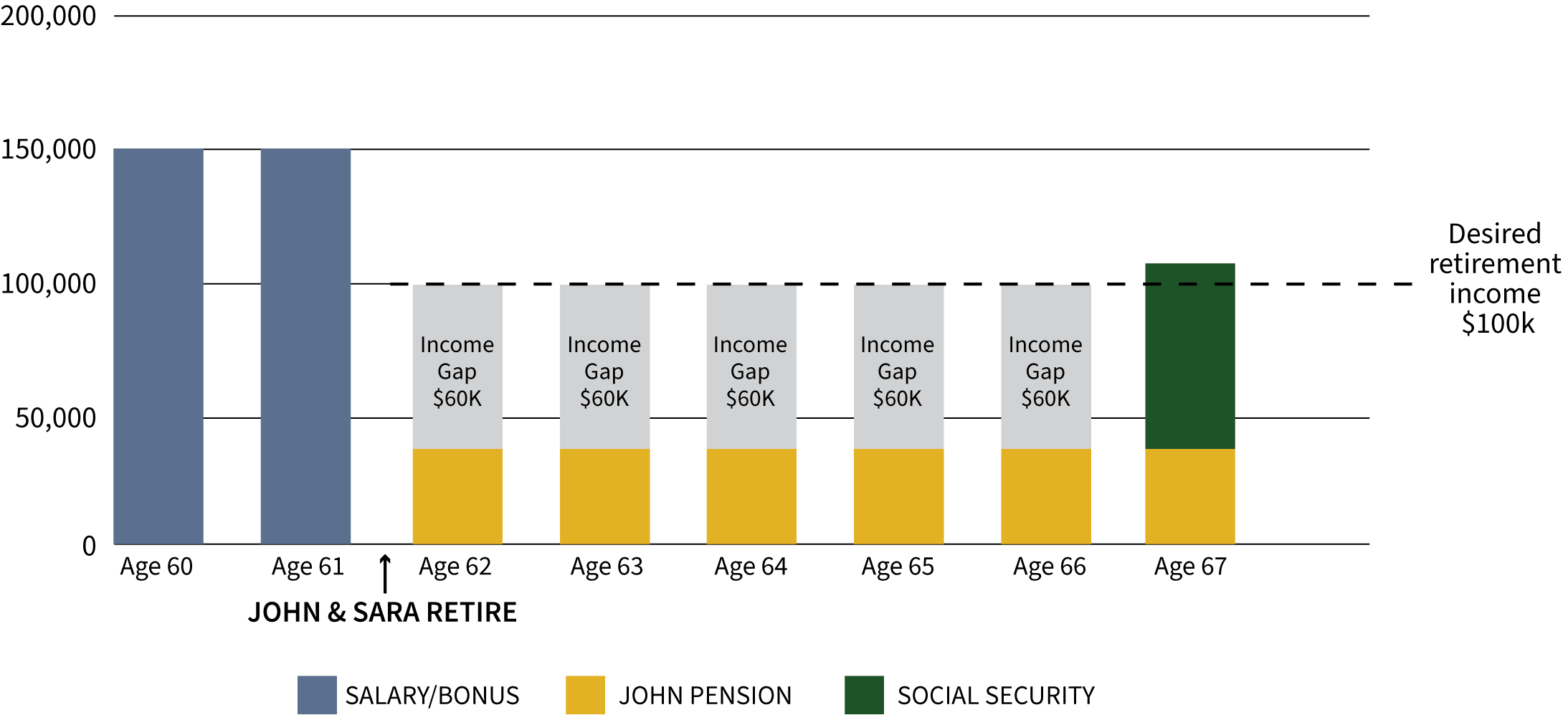

You can see that John and Sara will have an income gap of $60,000 for the five years before Social Security kicks in. They will have to pull this from retirement accounts or other investments, which can lead to depleting assets sooner than anticipated.

You can see that John and Sara will have an income gap of $60,000 for the five years before Social Security kicks in. They will have to pull this from retirement accounts or other investments, which can lead to depleting assets sooner than anticipated. The gap they previously had to make up is now filled by Sara’s distributions from her deferred comp plan. This has a significantly positive impact on their future because now the couple can let their retirement and investment assets continue to grow over the five-year period and use those gains later to supplement their income.

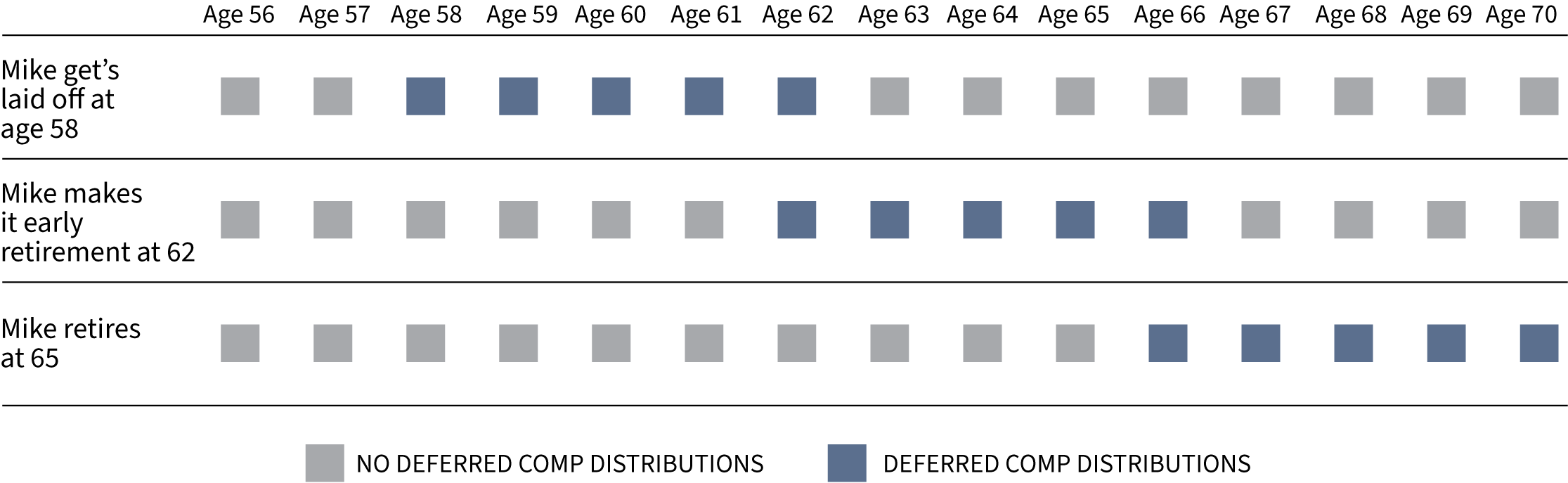

The gap they previously had to make up is now filled by Sara’s distributions from her deferred comp plan. This has a significantly positive impact on their future because now the couple can let their retirement and investment assets continue to grow over the five-year period and use those gains later to supplement their income.  Looking at this chart, you can see that no matter when Mike leaves MetLife, he has a purpose for his deferred compensation. If he gets laid off at 58 (or any age, for that matter), the deferred comp will pay out over the next five years. Being that the current value is $350,000, that could be around $70,000 in income each year. This will allow him to buy some time while he looks for another job, or he could accept a job making less money since he has this income to supplement his pay.

Looking at this chart, you can see that no matter when Mike leaves MetLife, he has a purpose for his deferred compensation. If he gets laid off at 58 (or any age, for that matter), the deferred comp will pay out over the next five years. Being that the current value is $350,000, that could be around $70,000 in income each year. This will allow him to buy some time while he looks for another job, or he could accept a job making less money since he has this income to supplement his pay.