The thought of a recession can strike fear into the hearts of new investors or families in an uncertain financial situation. Though this downturn in the economy presents some distinct challenges, it doesn’t have to spell disaster. With a thoughtful allocation of funds and patient money management, you can weather this type of storm more comfortably than you may have imagined.

How Can You Tell That We’re in a Recession?

A recession typically occurs when there are two consecutive calendar quarters of negative real Gross Domestic Product (GDP). The overall decline may last for months or even years. Though there are several other indicators that point toward a recession, consecutive quarters of retraction are considered one of the most reliable signs. A recession was declared for each of the last 10 times the U.S. economy shrank for two consecutive quarters.

Some other indicators of a recession include:

- An increase in unemployment

- Changes to the yield curve such that short-term government bonds pay more than long-term ones

- Decline in retail sales

- Decline in the ISM manufacturing index

- Rising commodity prices

- Rising inflation

How Do Recessions Occur?

Recessions are commonly triggered by a number of simultaneous business failures. As a result, companies have to cut back on workers and production. Spending and investment slow down. This in turn causes the GDP to decline. As companies respond by tightening their belts and laying off workers, unemployment begins to rise.

The U.S. has experienced eight recessions since 1969. These were preceded by economic imbalances. An expansion usually comes before a recession, but it’s nearly impossible to predict exactly when the economy will turn. A financial bubble, fast-paced inflation, or a shock to the economy like a spike in oil prices can all tip the scales. When the recession occurs, interest rates, commodity prices, and inflation all go on the rise.

How Long Do Recessions Typically Last?

Recessions usually last somewhere between six and 12 months. The last eight recessions to hit the U.S. economy averaged over 10 months in length, though the most recent one was very brief, lasting just two months. A recession is over when the economy shows signs of growth again. However, this growth may occur very slowly, leaving individuals and businesses to face a lengthy recovery period. For context, here are some details on the length of prior recessions:

- December 1969 to November 1970: 11 months

- November 1973 to March 1975: 16 months

- January 1980 to June 1980: 6 months

- July 1981 to November 1982: 16 months

- July 1990 to March 1991: 9 months

- March 2001 to November 2001: 8 months

- December 2007 to June 2009: 19 months

- February 2020 to March 2020: 2 months

How Will a Recession Affect My Portfolio and Investments?

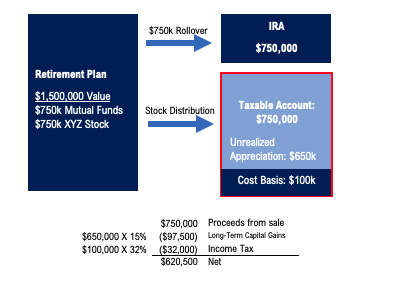

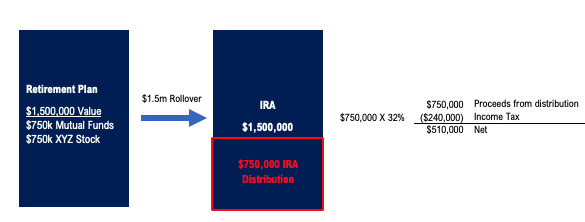

Portfolio diversification will play a major role in determining how your portfolio balance will be impacted by a recession. A balanced portfolio consisting of stock and bonds will often experience less downturn from a recession than a portfolio invested solely in stocks. That’s because stocks and bonds typically do not move in the same direction. The most recent exception to this was last year in 2022 when both stocks and bonds ended the year negative. This was due to the Fed’s decision to raise rates quickly to combat high inflation. A case like this is rare and has only been seen once since 1970. That being said, building a diversified portfolio consisting of many different asset classes will help to mitigate large swings in portfolio value in most cases.

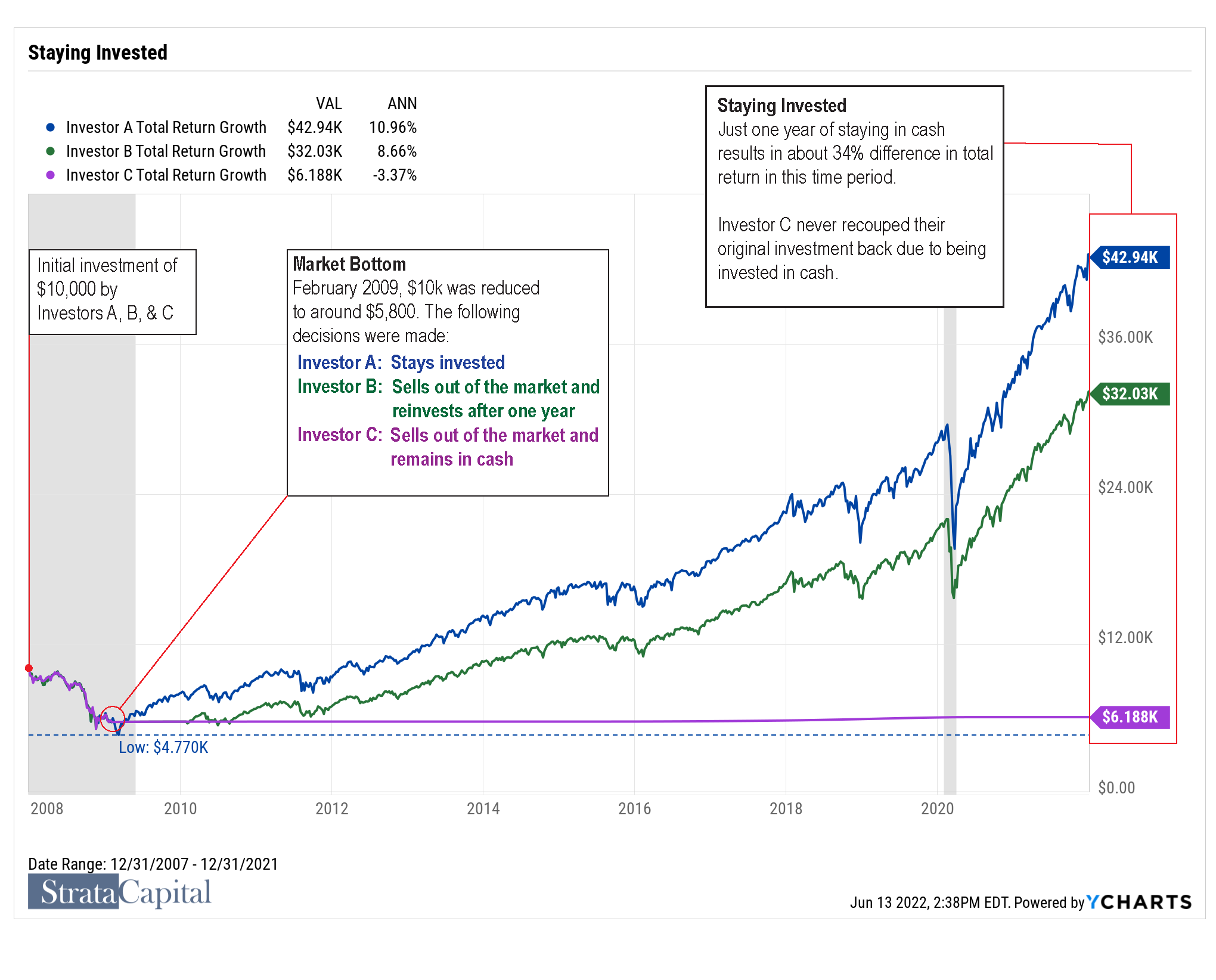

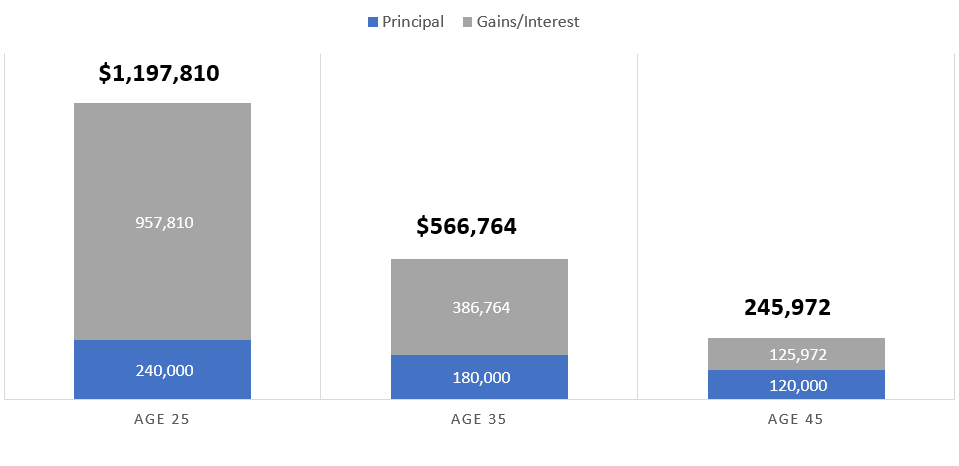

Though pullbacks may seem alarming, it’s important to recognize that these are usually temporary and often necessary. In 21 of the last 26 years, the U.S. equity markets finished positive, even though the average annual pullback was -15.2% intra-year. For most, the best strategy for dealing with a market downturn is patiently waiting for the market to recover and not making any rash decisions that causes you miss a recovery.

How Does This Affect My Financial Plans and Goals?

If your investment portfolio is aligned with your risk tolerance, a recession shouldn’t affect your long-term plans and goals. An investor planning to purchase a home within the next year wouldn’t be heavily invested in high-risk equities. Thus, the recession would not have a notable impact on their financial situation. On the other end of the spectrum, if your goals are long-term with a higher risk tolerance, you will likely be able to weather the recession and wait patiently for the economy to recover before you seek to cash in on your investments.

If you already have some cash on the sidelines, have a longer time horizon, and are in a strong financial position, you may want to use a recession as a buying opportunity. Recessions typically lead to depressed equity pricing for a period of time, this opportunity doesn’t come often, but when it does, you’ll be able to get in at lower prices.

You should only use this strategy if you have ample emergency savings and you can afford to wait at least several years for a return on your investment. A recession is not a good time to check obsessively on your portfolio looking for returns. Rather, this is a period for quiet patience.

What Should I Do If I’m Not Prepared for a Recession?

If you haven’t prepared mindfully for a recession, you should do a deep dive into your finances to get a solid idea of where you stand. It’s important to have a clear understanding of all your assets and investments during this time. If you find yourself in a difficult situation during the recession, you may need to push some of your goals forward, particularly if you’re looking toward a major purchase like a new home.

In some cases, individuals who felt they were in serious trouble discovered that their situations were more manageable than they thought. Even minor adjustments can have a measurable impact on your financial situation. If you’re feeling anxious about your finances, seek the help of a financial professional. Running a detailed analysis of your situation will give you the information that you need to move forward wisely and care for your future in the best way possible.

Don’t let fear overcome you in the face of uncertain economic times. With an experienced financial advisor on your side, you can make it through a recession safely, keeping your assets well protected and your goals close at hand. Working with us here at Strata Capital, you’ll gain the insights you need to make wise choices moving forward that will help you cope successfully with whatever the recession may throw at you.