Wondering what to do with that retirement account from your previous employer? If you’ve worked in Corporate America, there’s a good chance this account is a cash balance pension plan. Unlike traditional pensions, these plans often provide more options when you leave a company.

What is a Cash Balance Pension Plan?

A cash balance pension plan is a retirement plan where the company contributes on behalf of its employees. Unlike a 401(k), employees do not contribute to these plans. Think of it as an additional 401(k) match from your employer. The company deposits funds into the plan based on your compensation, and rather than being invested, the balance typically grows at a crediting rate based on interest rates.

When you leave the company, your plan balance usually continues to earn interest credits, but the company stops making contributions.

What to Do with Your Plan After Leaving the Company

If you’ve left your job and are wondering what to do with your old cash balance pension plan, the answer will depend on your unique situation. Generally, these plans offer four different options, which can vary based on your former employer.

Option 1: Annuitize the cash balance pension, turning it into a monthly income stream. This works similarly to creating your own “traditional pension.”

Option 2: Roll the balance over into an IRA. This will allow you to continue investing the funds how you’d like.

Option 3: Leave the money in the plan. Some companies allow this, and some do not. Most companies have an age at which you MUST initiate another option, usually 65.

Option 4: Take a lump sum distribution. It’s important to note the entire balance would be taxed as ordinary income.

Taking a lump sum distribution is rarely the best choice unless your plan balance is relatively small. Therefore, we’ll focus only on the other options for the rest of this article.

We’ll walk you through each option and the scenarios in which it might make sense. This will give you a complete understanding to help guide your decision-making process. Finally, we’ll provide a list of steps to determine which option may be most favorable for your situation.

Option 1: Annuitizing the Plan to Create an Income Stream

Think of this option as trading in the balance of your cash balance plan for a “traditional pension.” Company plans typically offer multiple payout options, such as single or joint life.

If your goal is to create additional income in retirement, this may be the right option for you, especially if you are retiring now and need the income immediately. However, this option is not ideal if you prefer flexibility, liquidity, and control of your assets. It may also be less appealing if you are still working and are far from retirement.

What are the advantages of annuitizing my cash balance pension?

- It allows you to generate an income stream to supplement your other retirement income sources.

- The joint payout option ensures the income stream lasts for both your and your spouse’s lives, hedging against longevity and premature death risks.

- The investment risk is transferred to the company, meaning you do not have to manage the assets; you just receive the income.

What are the disadvantages of annuitizing my cash balance pension?

- You’re trading an asset for an income stream. You lose liquidity, so if you need the cash sooner, you can’t access it.

- The income stream ends with you (or your spouse if they outlive you and you’ve chosen the joint option). It will not be passed along to your heirs or be part of your estate.

- There is the potential opportunity cost of not being able to invest the balance elsewhere.

Important Note: If you determine that you want more guaranteed income and are planning on annuitizing your cash balance pension, it’s always advisable to price out other income-producing investments (such as outside annuities) to compare income amounts. You might find a higher income rate at another insurance company.

Option 2: Rolling Over Your Cash Balance Pension to an IRA

Just like you can roll over your 401(k), you can also roll over your cash balance pension into an IRA. You can transfer it to an existing IRA or set up a new one.

What are the advantages of rolling over my cash balance pension?

- You have complete control over how funds are invested, allowing you to align your investment strategy with your overall financial plan.

- You maintain the asset, which can now be passed down to your heirs and your estate.

- If you decide you prefer a guaranteed income stream later, you can always purchase an annuity in the future.

- Distributions are easier. Most cash balance plans do not permit partial distributions, but rolling over to an IRA gives you full control over distributions, making it easier to receive your money (e.g., direct deposit vs. a mailed check).

- This option offers the most flexibility.

What are the disadvantages of rolling over my cash balance pension?

- You bear the investment risk, so if the investment decreases in value, so does your asset.

- You no longer receive the interest credit you would have if you left the money in the plan.

- You can no longer annuitize through your company’s plan (see Option 1). However, you still have the option to annuitize through another insurance company at a later date if you choose to do so.

Option 3: Leave the Money in the Cash Balance Plan

Most companies allow you to leave the money inside the cash balance plan even after you’ve left the firm. However, there is usually an age limit by which you must choose another option, typically age 65.

If you leave the money in the plan, you will continue to earn interest credits. The crediting rate is usually based on a treasury or corporate bond rate published by the IRS. Be sure to check your plan’s Summary Plan Description for more details.

What are the advantages of leaving money inside my cash balance pension plan?

- Ideal for conservative investors who do not need additional income right now.

- Beneficial if you are satisfied with the interest rate it’s paying, especially if it’s higher than what you could get elsewhere.

- If you’re close to retirement, it keeps the annuitized income option available for later use.

What are the disadvantages of leaving my money inside my cash balance pension plan?

- Potential opportunity cost for aggressive investors or those far from retirement who might benefit from investing in riskier assets.

- There is a time limit on how long you can keep the funds in the plan.

- Facing limited liquidity compared to other investments, making it harder to access funds quickly.

- Many plans do not allow for partial distributions.

Steps to Evaluate What Cash Balance Pension Option is Best for You

This decision should not be made in isolation. It’s crucial to assess how your choice integrates with your overall financial plan. Since the decision is permanent, be thorough in your evaluation. Here are the steps you can take to start the process:

Step 1: Determine Your Retirement Status

The first step is to consider whether you are retiring soon or planning to continue working. If you’re retiring, you’ll need immediate income; if you’re still working, you have more time before requiring retirement income. This distinction will also impact the Internal Rate of Return (IRR) calculations in later steps.

Step 2: Assess Your Guaranteed Income Sources

Identify your sources of guaranteed income in retirement, such as Social Security, pensions, and annuities.

Step 3: Estimate Your Retirement Expenses

Calculate your anticipated expenses in retirement. Focus on essential needs like housing and food before considering discretionary spending like vacations and entertainment.

Step 4: Identify Any Income Gaps

Compare your estimated expenses with your guaranteed income sources to identify any shortfalls. If there is a gap, consider whether annuitizing the cash balance pension can fill it. If there isn’t a gap, annuitizing might not be necessary.

Step 5: Calculate the Internal Rate of Return (IRR)

Use the IRR formula in Excel or have your financial advisor run the analysis for you. The IRR will give you a number to compare against alternative investment strategies. (Tip: If your advisor can’t run this analysis, it might be time to find a new one!)

Step 6: Compare IRR to Investment Strategies

Always compare your cash balance pension annuitization IRR with other investment options. Annuitizing the pension might provide a steady income stream, but it’s essential to evaluate whether it’s the best choice compared to other investment strategies.

Step 7: Run Financial Forecasts for Each Option

This step is crucial. Run separate financial forecasts for each option to see how they affect your long-term financial future. Compare these scenarios to understand the impact on your overall financial health and legacy planning.

By following these steps, you’ll gain a better understanding of which option makes the most sense for your unique situation. Always run scenarios against your overarching financial plan to ensure you make the best decision for your financial future.

Final Thoughts on Managing Your Cash Balance Pension

Deciding what to do with your old cash balance pension plan is a significant choice that can impact your financial future. It’s essential to consider how each option fits into your overall financial strategy and long-term goals. Whether you choose to annuitize, roll over into an IRA, or leave the funds in the plan, understanding the advantages and disadvantages of each option is crucial.

By thoroughly evaluating your situation and running detailed forecasts, you can make an informed decision that aligns with your retirement goals and financial needs. Remember, this decision is permanent, so take the time to explore all your options carefully.

If you’d like assistance exploring the best option for your old cash balance pension plan, we’re here to help. Schedule a free consultation with us today. Together, we’ll analyze your unique situation and guide you toward making an informed decision tailored to your needs.

Strata Capital is a wealth management firm serving corporate executives, professionals, and entrepreneurs in the New York Tri-State Area, focusing on corporate benefits and executive compensation. Co-founded by David D’Albero and Carmine Coppola, the firm specializes in making the complex simple to ensure clients feel confident in their financial decisions. They can be reached by phone at (212) 367-2855, via email at carmine@stratacapital.co, or by visiting their website at stratacapital.co.

Cornerstone Planning Group, Inc., (“CSPG”) is an SEC registered investment advisory firm. The information contained herein should not be construed as personalized investment advice and should not be considered as a solicitation for investment advisory service. The information (e.g., tax ) provided is believed to be accurate however CSPG does not guarantee or otherwise warrant such information. For more information regarding CSPG you can refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) and review our Form ADV Brochure and other disclosures.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

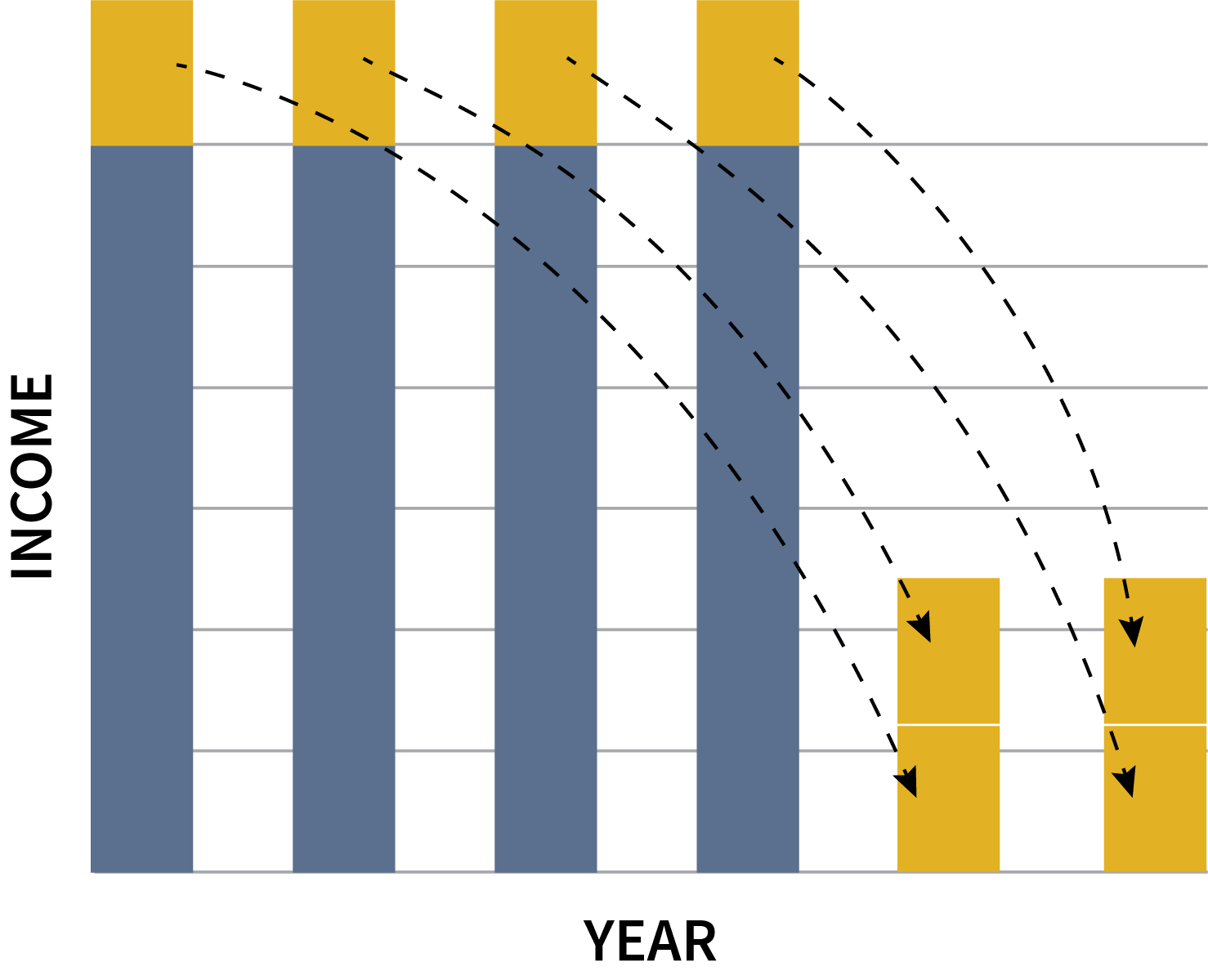

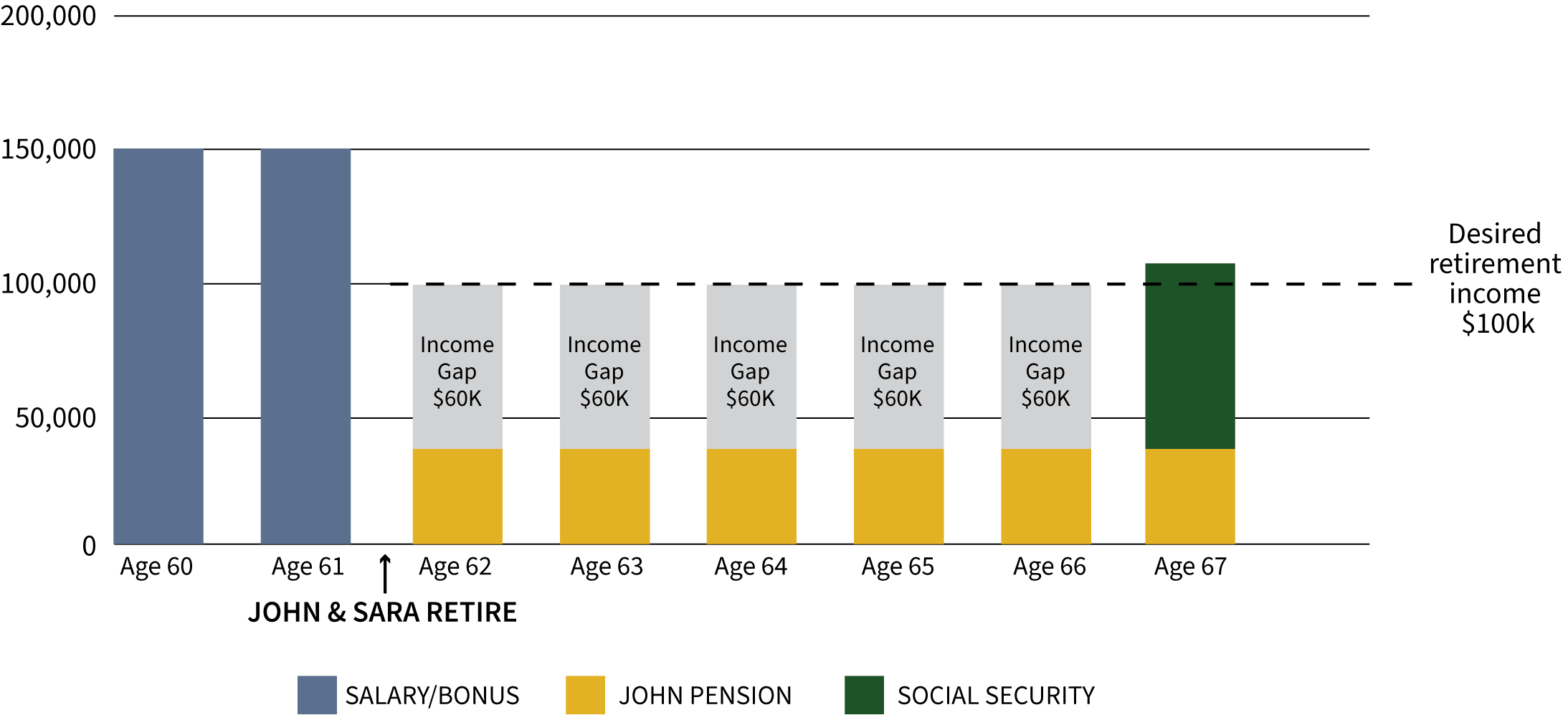

You can see that John and Sara will have an income gap of $60,000 for the five years before Social Security kicks in. They will have to pull this from retirement accounts or other investments, which can lead to depleting assets sooner than anticipated.

You can see that John and Sara will have an income gap of $60,000 for the five years before Social Security kicks in. They will have to pull this from retirement accounts or other investments, which can lead to depleting assets sooner than anticipated. The gap they previously had to make up is now filled by Sara’s distributions from her deferred comp plan. This has a significantly positive impact on their future because now the couple can let their retirement and investment assets continue to grow over the five-year period and use those gains later to supplement their income.

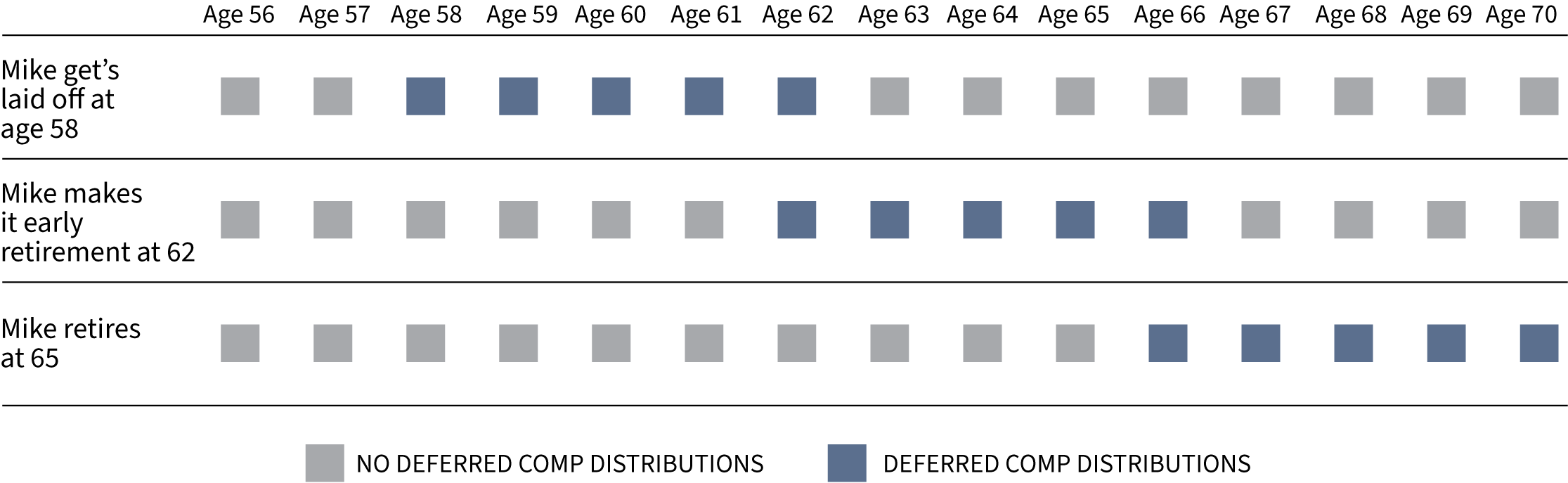

The gap they previously had to make up is now filled by Sara’s distributions from her deferred comp plan. This has a significantly positive impact on their future because now the couple can let their retirement and investment assets continue to grow over the five-year period and use those gains later to supplement their income.  Looking at this chart, you can see that no matter when Mike leaves MetLife, he has a purpose for his deferred compensation. If he gets laid off at 58 (or any age, for that matter), the deferred comp will pay out over the next five years. Being that the current value is $350,000, that could be around $70,000 in income each year. This will allow him to buy some time while he looks for another job, or he could accept a job making less money since he has this income to supplement his pay.

Looking at this chart, you can see that no matter when Mike leaves MetLife, he has a purpose for his deferred compensation. If he gets laid off at 58 (or any age, for that matter), the deferred comp will pay out over the next five years. Being that the current value is $350,000, that could be around $70,000 in income each year. This will allow him to buy some time while he looks for another job, or he could accept a job making less money since he has this income to supplement his pay.