By Carmine Coppola

If you work in corporate America, the probability that your company offers a deferred compensation plan is high. The term may be unfamiliar, but the concept probably isn’t. Deferred compensation is an arrangement that allows you to delay payment of a portion of your income until a later date when your taxable income—and related tax bracket—is likely lower.

If that sounds like a 401(k) plan, you’re not wrong. A 401(k) falls under the category of qualified deferred compensation plans, which are those protected by the Employee Retirement Income Security Act of 1974 (ERISA). Qualified deferred compensation plans come with strict fiduciary standards, such as restrictions on contribution amounts and requirements to hold plan assets in a separate trust out of reach from the company’s creditors. These plans also come with strict rules that limit advantages for high earners.

Nonqualified Deferred Compensation Plans

But a lesser-known and far more flexible tool is the nonqualified deferred compensation plan (NQDC), also known as elective deferral or supplemental executive retirement plans. These deferred compensation plans also allow you to pick investments and can even qualify for a company match (consider this a raise!); but unlike a 401(k) plan, a nonqualified deferred compensation plan places no limits on your contributions, no age restrictions on withdrawals, and no required minimum distributions.

You can put away and invest an uncapped amount each year, reducing your taxable income by the amount you defer. You can enjoy tax-deferred investment growth until distribution, with flexibility on when you start receiving distributions – they can occur at retirement or sooner if you want to align payouts with other earlier financial goals. Distributions are taxed at ordinary income tax rates, so imagine how you can use this strategically alongside your tax planning.

It’s important to remember that all the potential benefits of NQDC plans come with some risks. It’s essentially an I.O.U. from the company; if they go bankrupt, your deferred compensation contribution is considered unsecured debt and could be lost. If a significant portion of your wealth is also held in stock options and restricted stock units, relying heavily on deferred compensation could mean too much of your financial well-being depends on the company’s financial strength. Moreover, effectively leveraging deferred compensation plans requires careful thought and planning.

However, NQDC plans have been dubbed “golden handcuffs” for a reason. As a highly compensated employee, your work is a valuable asset to your employer, so the benefit is designed to incentivize retention. The more you make, the more you pay in taxes, and the more appealing the tax shelter is. If you intend to stay with the company, the financial advantages of using the plan strategically can be substantial and potentially well worth the carefully measured risk.

Key Considerations for Deferred Compensation Planning

You have some critical decisions when you elect to participate in a deferred compensation plan. Participation typically involves adhering to a designated enrollment period and establishing a written agreement with your employer. This agreement outlines crucial details, such as the amount of income to be deferred, the deferral period or schedule of distributions, and your investment choices.

With so many possibilities and so much at stake, deferred comp plans can feel overly complex and even intimidating. The best way to start thinking about your strategic approach is to break it down into three main components:

- What do you want to use the deferred compensation for?

- How much of your salary or bonus will you defer each year?

- When do distributions from the plan start, and how long do they last?

Once elections are made, they can be difficult or impossible to change, so you don’t want to go into this lightly. Before moving forward, it’s vital that you understand your options and look at the big picture.

We will explore four situations in which you can confidently and strategically leverage your nonqualified deferred compensation plan.

Strategy 1: Tax Reduction

Deferrals into an NQDC plan lower your taxable income in the year you defer income. So, if your total compensation was $300,000 and you decided to defer $25,000, your annual income would be $275,000.

A common strategy we use is offsetting other income, such as stock compensation or inherited IRA withdrawals, with their deferred comp.

Let’s look at an example.

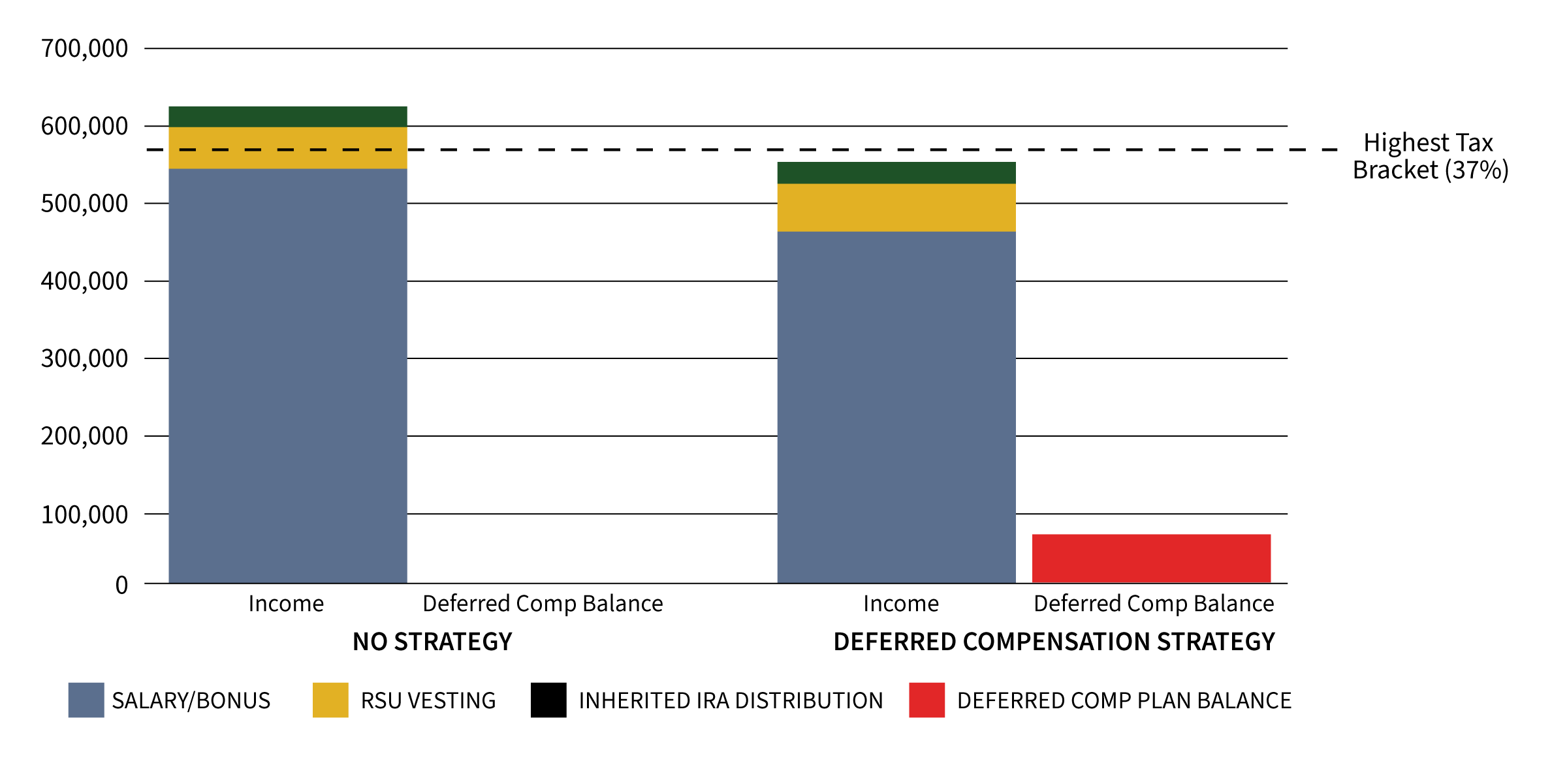

Gianna’s salary and bonus are $550,000 per year. She also receives stock compensation in the form of RSUs (restricted stock units), which, on average, is about $50,000 per year. RSUs are taxed as ordinary income when they vest, regardless of whether you sell the stock. She inherited an IRA from her father and is currently withdrawing $25,000 per year, which will continue for the next several years. This puts her total income at $625,000, placing her in the highest federal tax bracket. Keeping tax calculations simple for this example, Gianni would pay $187,636 in federal taxes. Making her effective tax rate 30.7%

Gianna does not need the additional $75,000 in income from the RSUs and IRA distribution, so she is losing a ton of money to taxes on income she will not be using right now. What can she do?

Gianna’s company offers her a deferred compensation plan. She decides to defer $75,000 of her bonus each year. This will offset the amount she receives from the stock compensation and inherited IRA distributions.

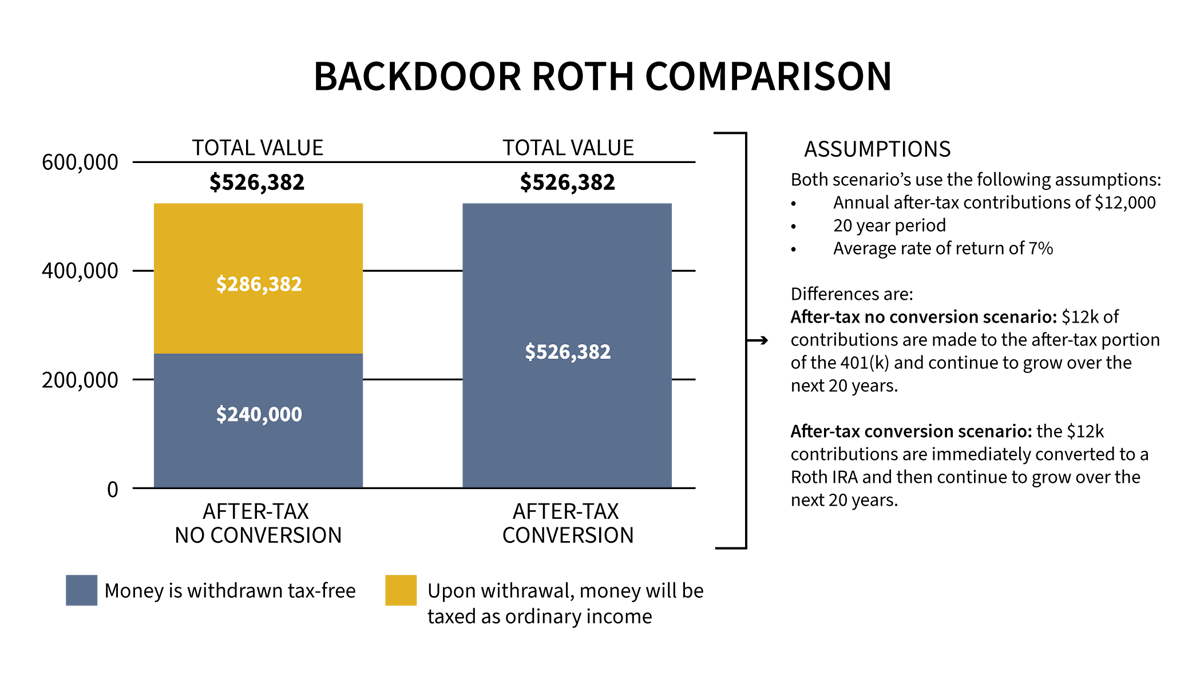

Why would she do this? Look at the chart below.

As you can see, Gianna’s current plan puts her just over the threshold for the highest tax bracket. Deferring $75,000 of her compensation allows Gianna to reduce her taxable income to $550,000, keeping her just beneath the highest tax bracket. And her federal tax bill would be reduced to $160,690, saving her about $27,000 in federal taxes! This strategy allows her to maintain the same lifestyle spending, while the $75,000 she defers can be invested for retirement inside her NQDC plan.

If she continues this over the next ten years, that is an additional $750,000 in retirement savings, not including any investment growth. She can do this without spending any less or adjusting her lifestyle now. She’ll also realize the potential advantage of paying less in taxes because when she takes the distributions, she will be retired and in a lower tax bracket.

Strategy 2: Saving for Specific Goals

This strategy is simple and effective. All it takes is aligning your deferred compensation distributions with a specific goal in mind. This goal can be anything from your children’s education expenses to a down payment on a vacation home. Let’s show you how this concept works.

Bill and Laura have ambitious plans for their future. They want to make sure college expenses are covered for both children and purchase their dream vacation home. Their son will start college in eight years and their daughter in ten years, and they’d like to purchase their vacation home before the kids start college.

Cash flow is great for Bill and Laura right now. Bill has a deferred compensation plan through his job, and he developed a strategy to defer his salary over the next six years to fund the couple’s goals.

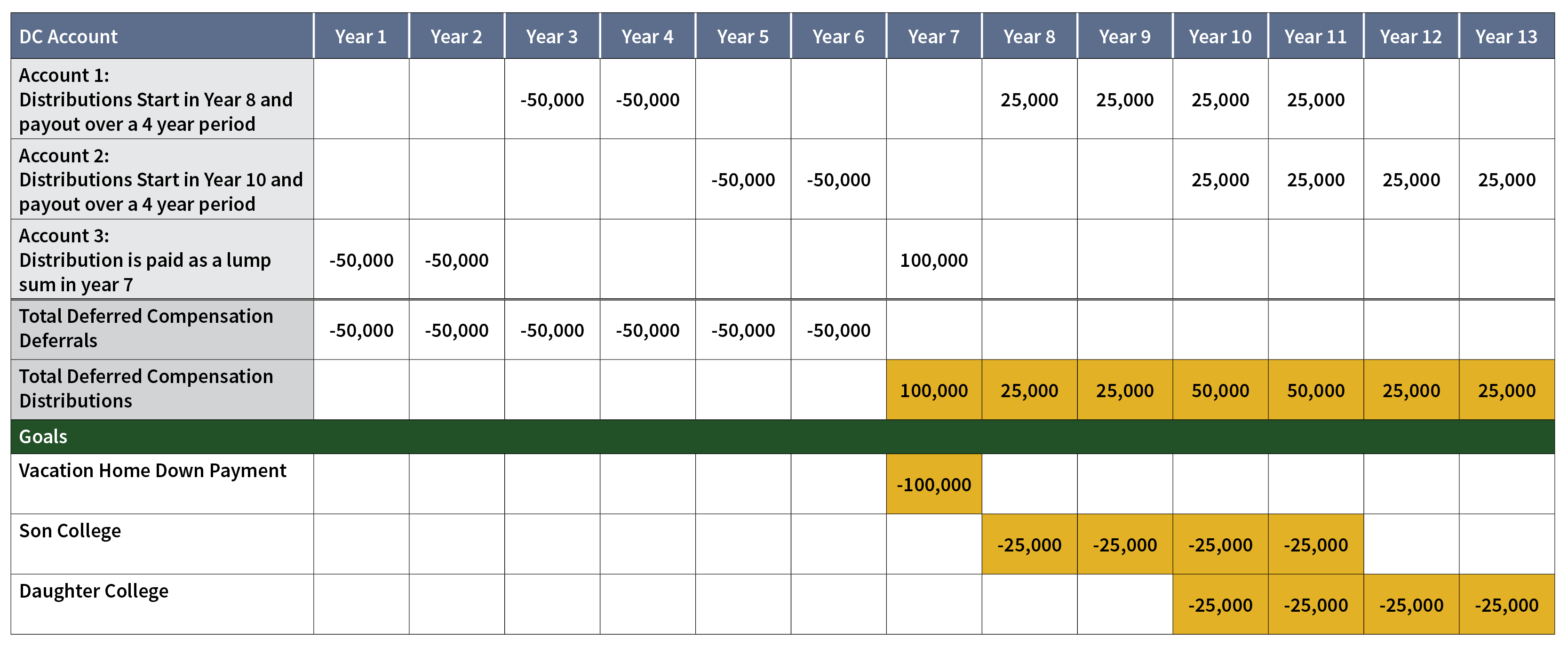

A common component of deferred compensation plans is the ability to have multiple accounts within the plan. Each account can have its own investment strategy and distribution schedule. When you make your elections, you decide which account you will be saving into. Bill’s plan allows him to save into three different accounts inside his deferred comp plan.

As you can see from the chart, Bill created three accounts — each with a specific goal in mind. Account #1 will begin paying out in Year 8, over four years to pay for his son’s college. Account #2 will begin paying out in Year 10, over four years to pay for his daughter’s college. Account #3 will be paid out in a lump sum in Year 7 to cover the down payment on the vacation home.

Bill decides that deferring $50,000 per year into the accounts over the next six years will allow him to achieve his financial goals. Looking at the yellow boxes on the schedule, you can see that when distributions are made from the plan, they are each aligned with specific goals.

It’s important to note that we did not account for any investment growth in this example. This is something you should consider when determining if this strategy is right for you. Also, deferred compensation distributions are taxed as ordinary income, so being aware of what your total taxable income is likely to be at the time of distribution is also crucial.

Strategy 3: Filling the Income Gap until Social Security

If you decide that you want to retire “early” or before age 65, the question most people ask is, “Where will my income come from?” Most people rely on Social Security to supplement their income in retirement. But how does that work if you retire earlier than you would like to begin drawing SSI or before you become eligible?

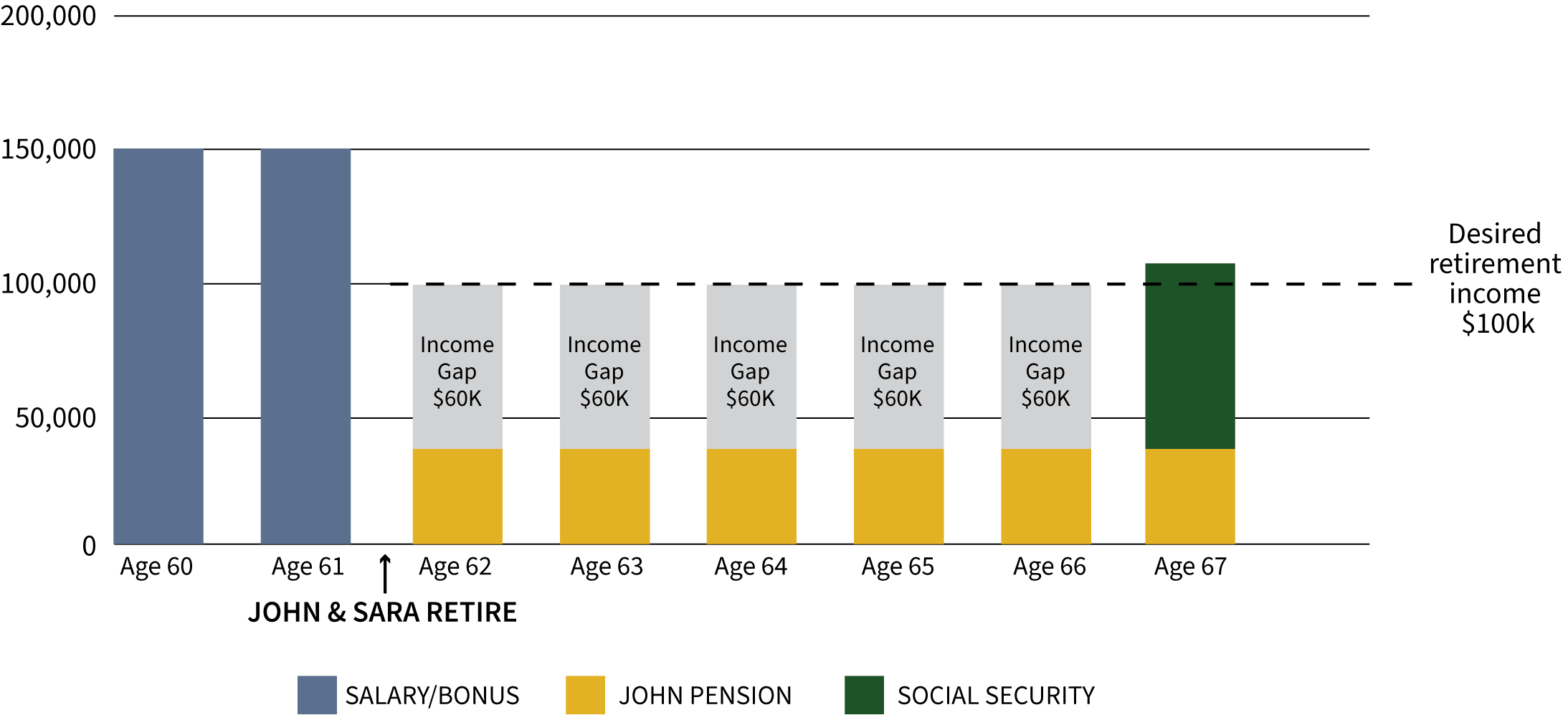

John and Sara are a married couple who are both 60 years old. They plan to retire when they are 62 and would like to wait until 67 to take Social Security. John has a pension that will start when he retires at age 62.

This is what their projected income looks like right now:

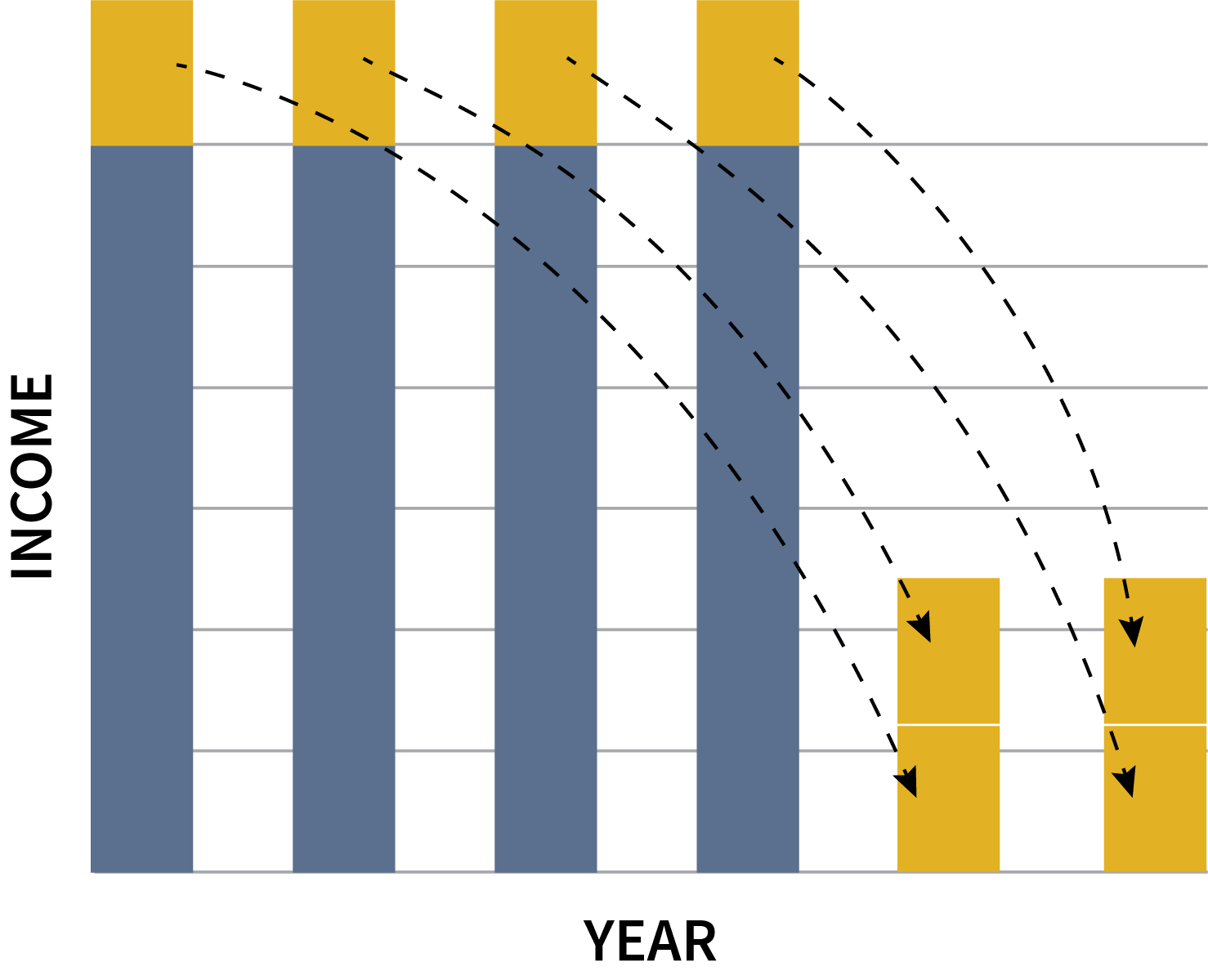

You can see that John and Sara will have an income gap of $60,000 for the five years before Social Security kicks in. They will have to pull this from retirement accounts or other investments, which can lead to depleting assets sooner than anticipated.

Let’s examine an alternate scenario in which Sara utilizes the deferred compensation plan through her employer. In this example, Sara defers 50% of her yearly bonus until retirement. The deferred compensation plan is to be distributed over five years, starting when Sara reaches age 62.

This is what their projected income looks like using Sara’s NQDC plan:

The gap they previously had to make up is now filled by Sara’s distributions from her deferred comp plan. This has a significantly positive impact on their future because now the couple can let their retirement and investment assets continue to grow over the five-year period and use those gains later to supplement their income.

It’s important to remember that a deferred compensation strategy like this needs to be reevaluated each year. There are a lot of moving parts to your plan; to stay on track, you need to adjust as needed constantly. For example, you may have some unexpected expenditures that affect your cash flow and may need more money in your paycheck instead of deferring that compensation later.

Strategy 4: Hedging for Getting Laid Off Early or Early Retirement

Let’s face it, companies go through layoffs and restructuring all the time. Unfortunately, the employees usually feel the most impact, especially the more highly compensated ones. Having a plan in place in the event you were to get laid off is essential to your financial well-being. The good news is if you have access to a deferred comp plan, it can be a great tool to hedge against uncertainty.

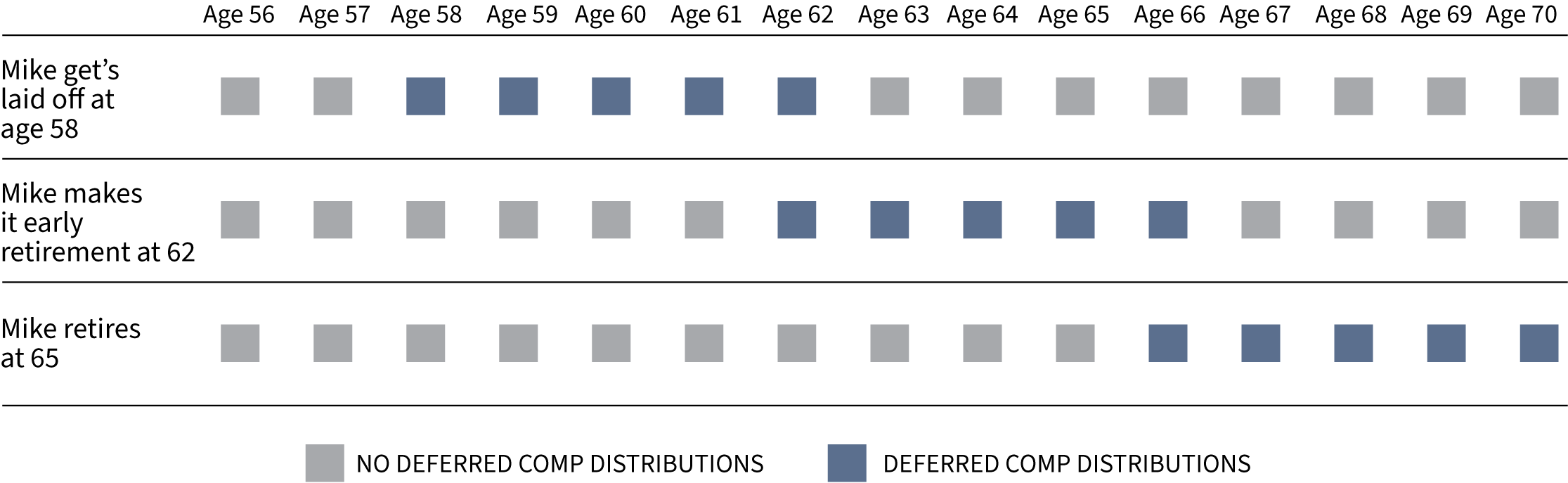

Let’s look at this in action. Mike has been a vice president at his company for the last ten years and is currently 55 years old. One of his major concerns is how an unexpected layoff would affect him and his family financially. To hedge against this possibility, he began deferring a portion of his bonus each year through his NQDC plan. He set the distribution date as the day he separates or retires from his company, and the distributions will be paid out over five years. The current value of the plan is $350,000.

Looking at this chart, you can see that no matter when Mike leaves the company, he has a purpose for his deferred compensation. If he gets laid off at 58 (or any age, for that matter), the deferred comp will pay out over the next five years. Being that the current value is $350,000, that could be around $70,000 in income each year. This will allow him to buy some time while he looks for another job, or he could accept a job making less money since he has this income to supplement his pay.

In the second scenario, Mike retires early at 62. He would receive his payout over the next five years until he is 66. The deferred compensation income would supplement his other retirement income until he takes Social Security. It could also pay for health insurance since he most likely would not be covered under his employer’s plan, and Medicare does not start until he is 65.

The last scenario has Mike retiring at the end of the year he turns 65, the longest he would continue working. If he’s able to stay that long, Mike could then use the deferred compensation to supplement his retirement income. This would enable him to withdraw less from his retirement and investment assets, allowing them to continue growing. He can also defer Social Security until 70 to max out his benefit since the NQDC payout would supplement his income in the meantime. The point is that Mike would have a lot of options and flexibility.

Defer, Don’t Delay

Deferred compensation is a potent tool that necessitates a thoughtful approach. Carefully weigh your options and proceed with cautious enthusiasm — sooner rather than later. Defer your compensation, but don’t delay putting the plan to work for your future; remember, time is valuable.

Decisions regarding deferred compensation plans should be intricately woven into the fabric of your comprehensive financial and retirement plans. Given the complexity and stakes involved, we recommend collaborating closely with a seasoned financial advisor to help navigate the myriad possibilities and make informed choices aligned with your long-term goals.

As specialists in executive wealth planning, we offer a complimentary consultation to answer your deferred compensation questions. You can schedule a free session with our team here.

Strata Capital is a wealth management firm serving corporate executives, professionals, and entrepreneurs in the New York Tri-State Area, focusing on corporate benefits and executive compensation. Co-founded by David D’Albero and Carmine Coppola, the firm specializes in making the complex simple to ensure clients feel confident in their financial decisions. They can be reached by phone at (212) 367-2855, via email at carmine@stratacapital.co, or by visiting their website at stratacapital.co.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This material was prepared by Crystal Marketing Solutions, LLC, and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate and is intended merely for educational purposes, not as advice.